Peter Hirshberg spoke of Opportunity Zones and localism as “America’s Next Great Frontier” at the Near Future Summit 2019 #NFS19 during their “Local Maximum” session. The capsule focused on how Big Data meets public/private partnerships to bring new solutions to communities in record speed.

America loves a frontier, it’s our national myth. Think Kennedy’s New Frontier, or Reagan’s city on a hill. That’s when our national character is best. We’re kind of vile when we don’t have that, when we’re told our story is, “sorry we’re closed, go fight over the pickings.” Today I’d like you to consider that we are at a “Frontier Again,” in America. This isn’t just a metaphor. We’re in the midst of remaking our cities for a very different economy. Rediscovering downtowns with great bones that were neglected in a former era which now attracts new people, new companies, new ideas.

You’d know this frontier is working if you saw a lot of experiments and progress toward our near future challenge. This may explain why localism is having such a moment, including this moment, at the Near Future Summit. At a time when we’ve lost faith in national institutions, local institutions and initiatives are flourishing!

Which is great because one thing the left and right can agree on is the future probably won’t be coming from Washington. We have to make decentralized mechanisms work in synchrony and find ways to unleash capital and value commensurate with our challenges.

By the way, this shouldn’t be surprise. Local is a defining part of the system architecture of America – were highly distributed!

Justice Louis Brandeis argued for this in 1932 when he wrote that states are Laboratories of Democracy to try novel social and economic experiments without risk to the rest of the country. Tocqueville was astounded by the American urge to build civic association when we wrote Democracy in America a century before that. “In France they’d call the King. In America they call a meeting, and then do an experiment,” said Tocqueville.

Today I’d like to focus on one mechanism we might use to accelerate these efforts, take a look at a new form of community development, report on its progress, and invite all of us to help shape its future.

We have to make local approaches meet the challenges of automation, the future of work, the future of capitalism, climate change. To connect these local experiments. And find a way to help pay for them.

Right on cue something kind of unexpected happened. Republican Senator Tim Scott, Democrat Cory Booker and Sean Parker started asking how might capital gains siting on the side lines be deployed in our cities to address the problems of our time. It was timely, because just as this was going on, capital was being deployed in our cites…

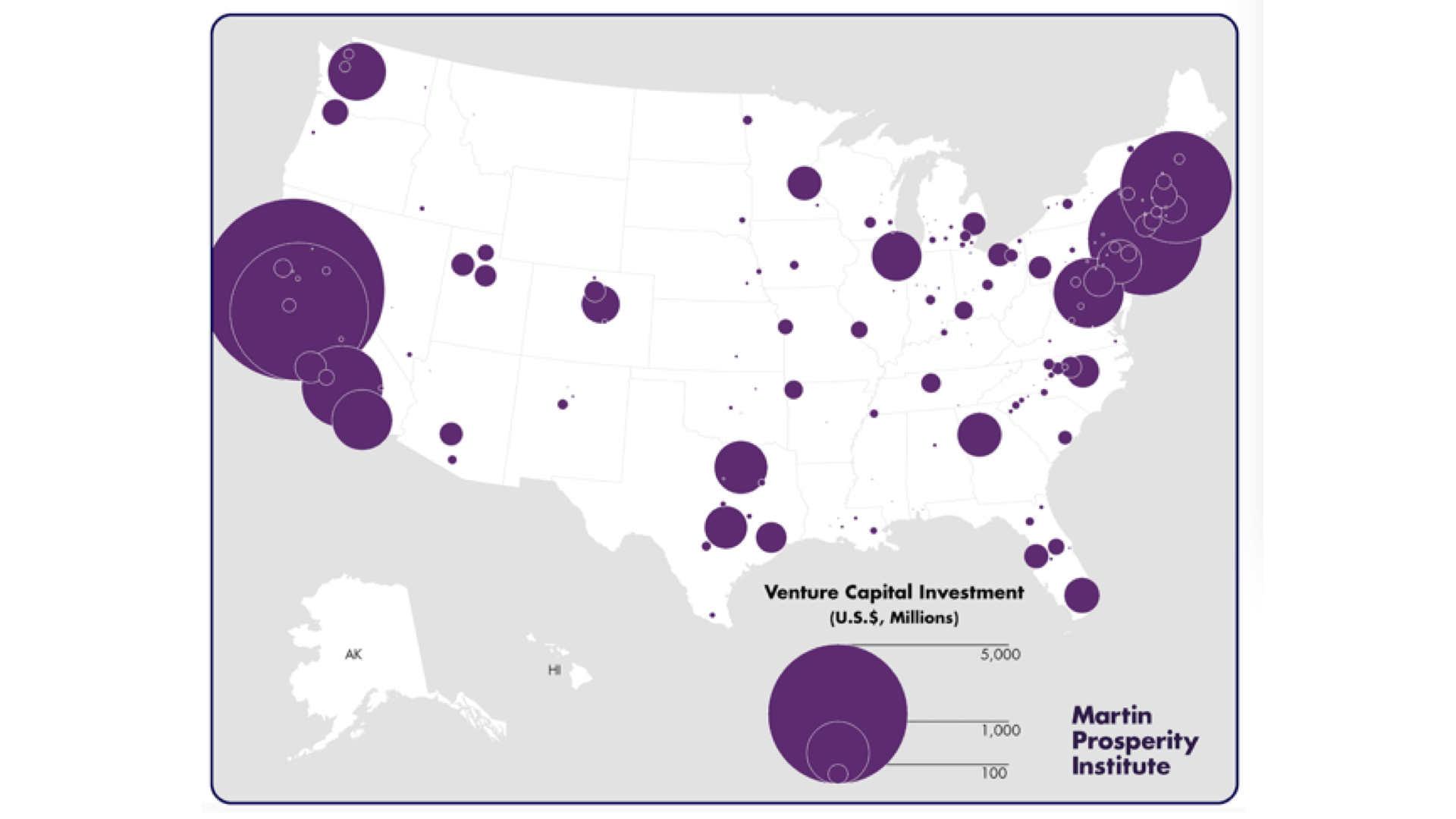

…but only in about 5 of them. 5 metros accounted for a third of our nation’s tech growth from 2010 to 2014.

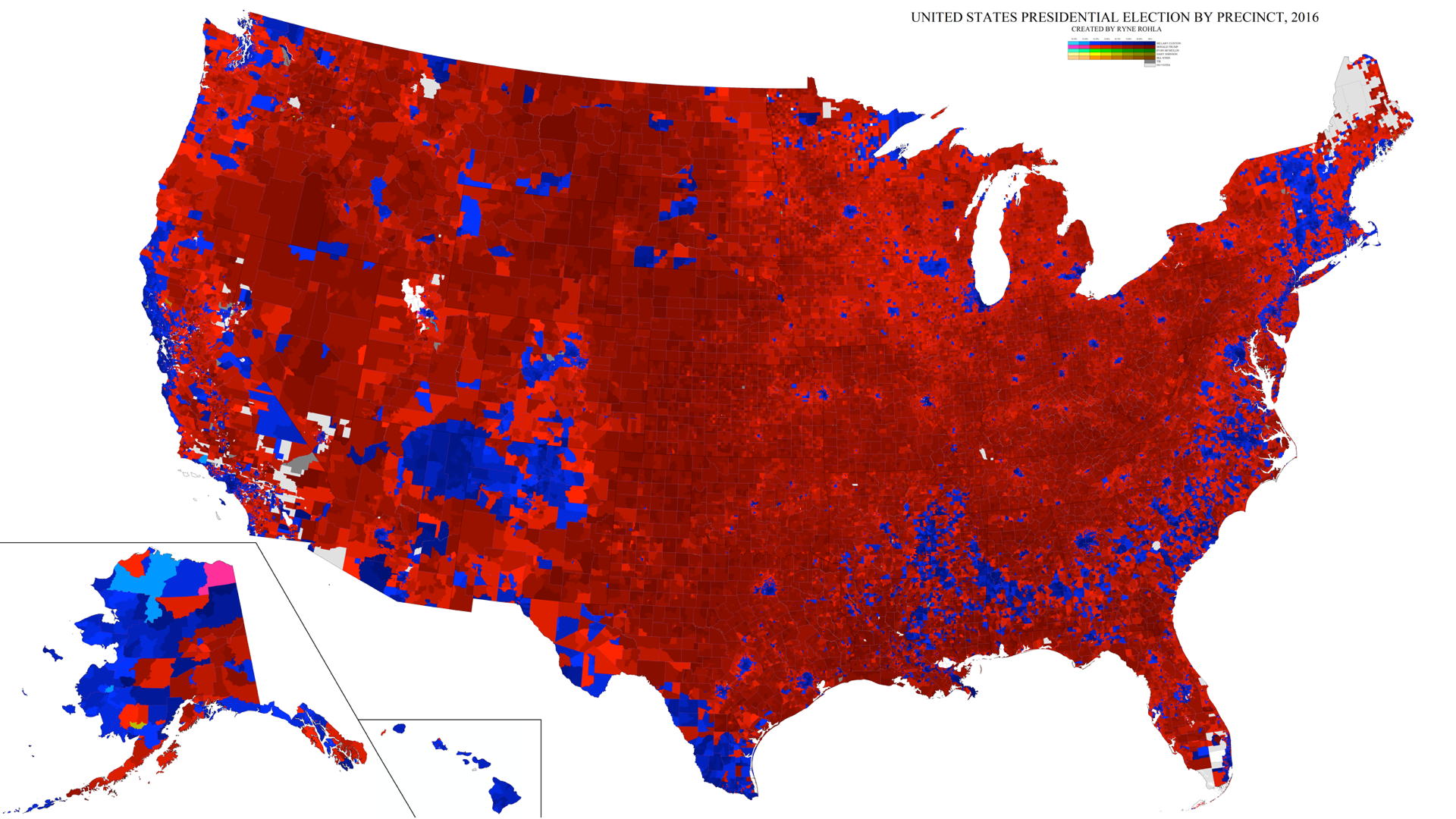

Which was kind of polarizing and corrosive, resulting in this electoral snapshot of America. And so, the birth child of Republication worship of private markets and the progressive ideals of Democrats resulted in a mechanism that might move a few hundred billion dollars into underserved areas.

We know this as the Opportunity Zone provision in the Trump tax cut. Governors designated 8,700 underperforming census tracks in all 50 states for tax advantaged investment. With the potential to serve About 31 million Americans. Think about it: 8,700 zones, perhaps 100,000 experiments. That’s a lot of simulations innovation!

But here’s the rap on opportunity zones: It’s either a tax break that will give us more of the same, perhaps accelerating gentrification…

Or it jumpstarts experiments in the future of capitalism and the future of work, accelerating investments in affordable housing, placemaking and community development. The path we take depends a lot on the story we invent and tell ourselves, the vision of cities, and how investors, entrepreneurs and philanthropists shape this. There aren’t a lot of federal guard rails, to a great degree we get to make this up!

The program is a capital gains bonanza. Capital gains you have today can be deferred until 2026. If a new investment stays in the community for 10 years, its 100 percent tax exempt. The rules favor action: any fund has to start investing within 180 days!

In fact, if you look at the game mechanics of all this you might think it all this as, “The Near Future Acceleration Act” of 2019.

To pull this off we have to think in the broadest way about what’s possible, and how OZ’s can provide a canvas for so many investment types that can change our cities.

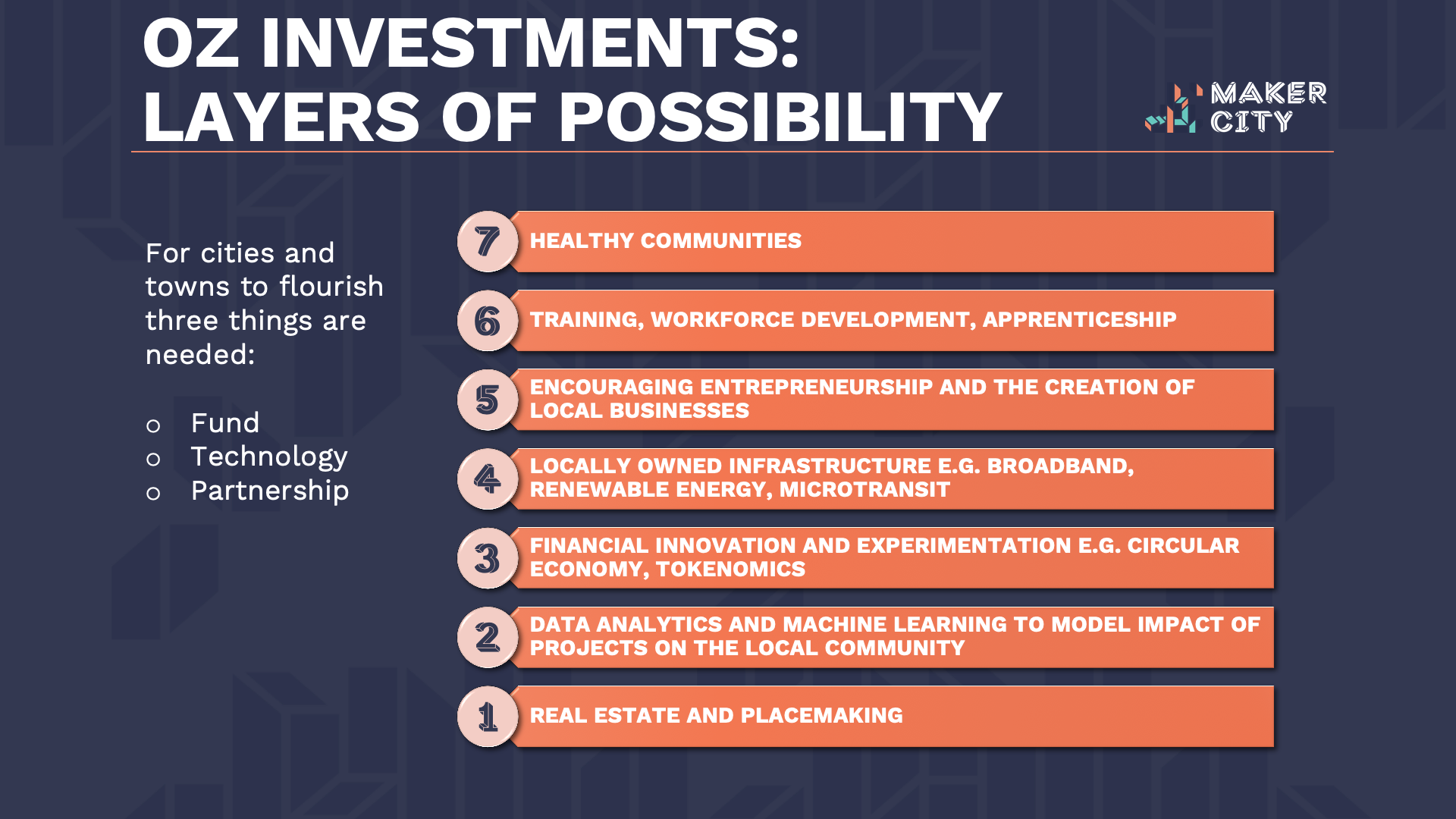

I grew up in computer networking, so I express this a 7-layer model, with the physical on the bottom and the most aspirational applications for our cites up top.

-Real estate, affordable housing, mixed use developments and placemaking form the foundation.

-A whole layer to measure and model impact which and allow broader participation in planning.

-Financial innovation, new forms of ownership, generative economies, and keeping wealth in communities must be a key part of the roadmap. Think of this as where we experiment on the future of capitalism.

-Locally owned infrastructure such as solar and broadband can keep wealth in communities and promote sustainability. All of these are viable opportunity zone investments.

-Local businesses as well as incubating high grown businesses are core to opportunity zone revitalization. The most models (which we’ll look at in a moment) suggest ways for that multiple forms of capital can reinforce one another.

-OZ’s can create a national market for many emerging innovations in workforce training and human capital development. Preparing citizens for the future is an essential role for cities.

-Healthy communities in many forms are a key principle in cities and must be in opportunity zones.

If opportunity zones are a new financial tool to stimulate interest, what they are leading to in cities is a new form of wiki-like community development. Cities and their ecosystems are self-organizing for the challenge. They are making it easier for investors. Working with Accelerate-for-America, led by L.A. Mayor Eric Garcetti, 40 cities have now developed a common investment prospectus, pitching their strengths, unique assets, and shovel ready deals.

Across cities, common investment types and new patterns are emerging. Imagine a Midwest downtown fund or innovation district fund or industrial zone fund. That’s completely new. Unlike the way bankers now package individual assets, this approach can create more holistic places – and create more value.

On Tuesday I was in Atlanta with their head of economic development. He told me how it’s is all playing out. Large funds are being raised, eager to deploy in cites, their 180-day clock ticking. Cites are racing to sort out cash flow projections, package deals and teach their communities how to get all this to pencil out. The momentum is palpable.

This is America so, road trip!

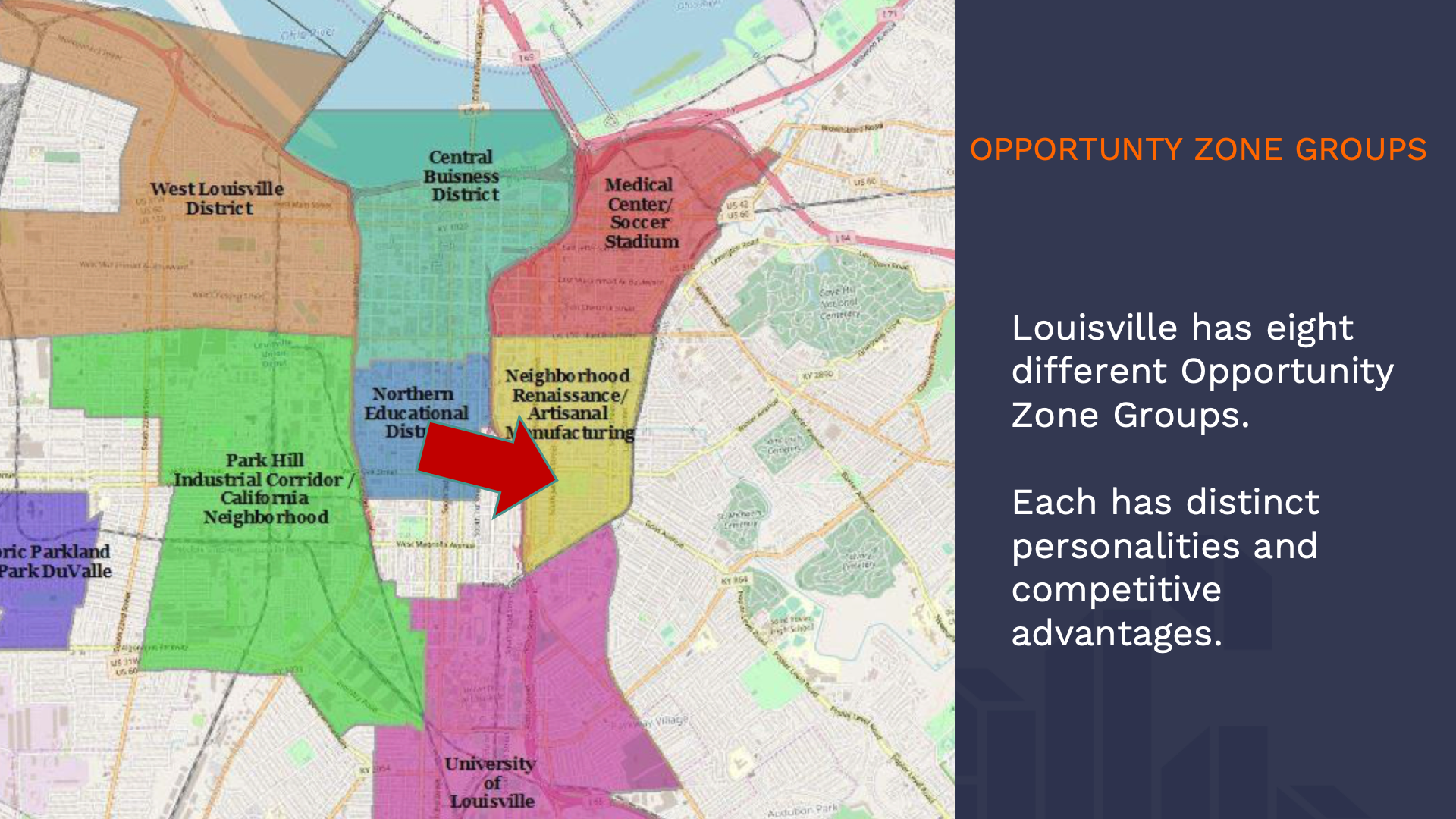

First stop, Louisville Kentucky which is piloting of one the most remarkable transformations of all: a way to reverse the effects of urban renewal that sliced neighborhoods with highways, paved downtown business districts with parking lots, and turned well-functioning minority neighborhoods to blight.

Meet Shelby Park. The construction of the Interstate turned a dynamic neighborhood connected to downtown into a place cut off from economic activity.

By 2010, 20% of the population was gone, half were below the poverty line, fully a quarter unemployed. Now what?

Enter Bruce Butler, community activist. He knew what wouldn’t work — trying to fix houses one by one.

Instead of focusing on one piece — “housing”, “startups”, or “workforce” — as a grant maker, investor, or government might, Bryce thought, ”lets fire up the ecosystem all at once.” It’s as if the more local you go, the more you can bring together all the components of a community, compress them in a critical mass and reignite an economy.

He launched a new type of community institution: hyper-focused on street corners and neighborhoods, able to raise and manage multiple types of capital. And execute on all-at-onceness!

Within 2 years, 4-million bucks led to 8 residential properties, renovated by the formerly incarcerated or homeless, 4 commercial buildings with thriving local business, and 5 venture funded growth companies.

That formula didn’t stay secret for long.

Ross Baird of village capital gave this approach a name, the “street corner thesis” and started Blueprint Local to do this work in Texas. His idea: this emerging pattern could be repeated in thousands of communities, driven by entrepreneurs who brought together multiple forms of capital and projects to make a street corner thrive. By packaging a rising community ecosystem rather than an individual project, he made the uninvestable, investable.

He’s open-sourcing his learnings so they can be shared nationally.

Remember those 7 layers I showed you? Many of them are at work here! This points out how central the relationship is between local entrepreneurs and community leaders in this new environment.

When it comes to localism, there is no place like home. I don’t think there is any place is better poised to take advantage of this frontier and new forms of business creation California’s Central Valley, our own emerging economy next door.

Meet Jake Soberal and Irma Olguin of Bitwise which is provides training, start-up capital and space for community acceleration in Fresno.

Their 250,000 square foot innovation center has fired the imagination of the economic and social development community.

Bitwise turns out 2,500 coders a year, 80 percent of whom have found jobs. 50% women, 50% minority. They are often the sons and daughters of migrant farm workers who might never have though tech was even a possibility.

The key to their success– all-at-oneceness! They created an education program, an incubator for 200 local businesses, and a place for the community. This is was catalytic to change Fresno’s story from “Americas most broken city,” to “underdog city-on the move!” Now they are expanding—exactly when there is national demand for this kind of business and expertise. And as the song goes, “If you can make it work in Fresno, you can make it work anywhere!”

I do want to address Steve Jurvetson’s Moon Base concern. The dark side of the moon is NOT an opportunity zone. Yes, its neglected and undeveloped, but no. On the other hand, many other exponentially transformative things are in opportunity zones.

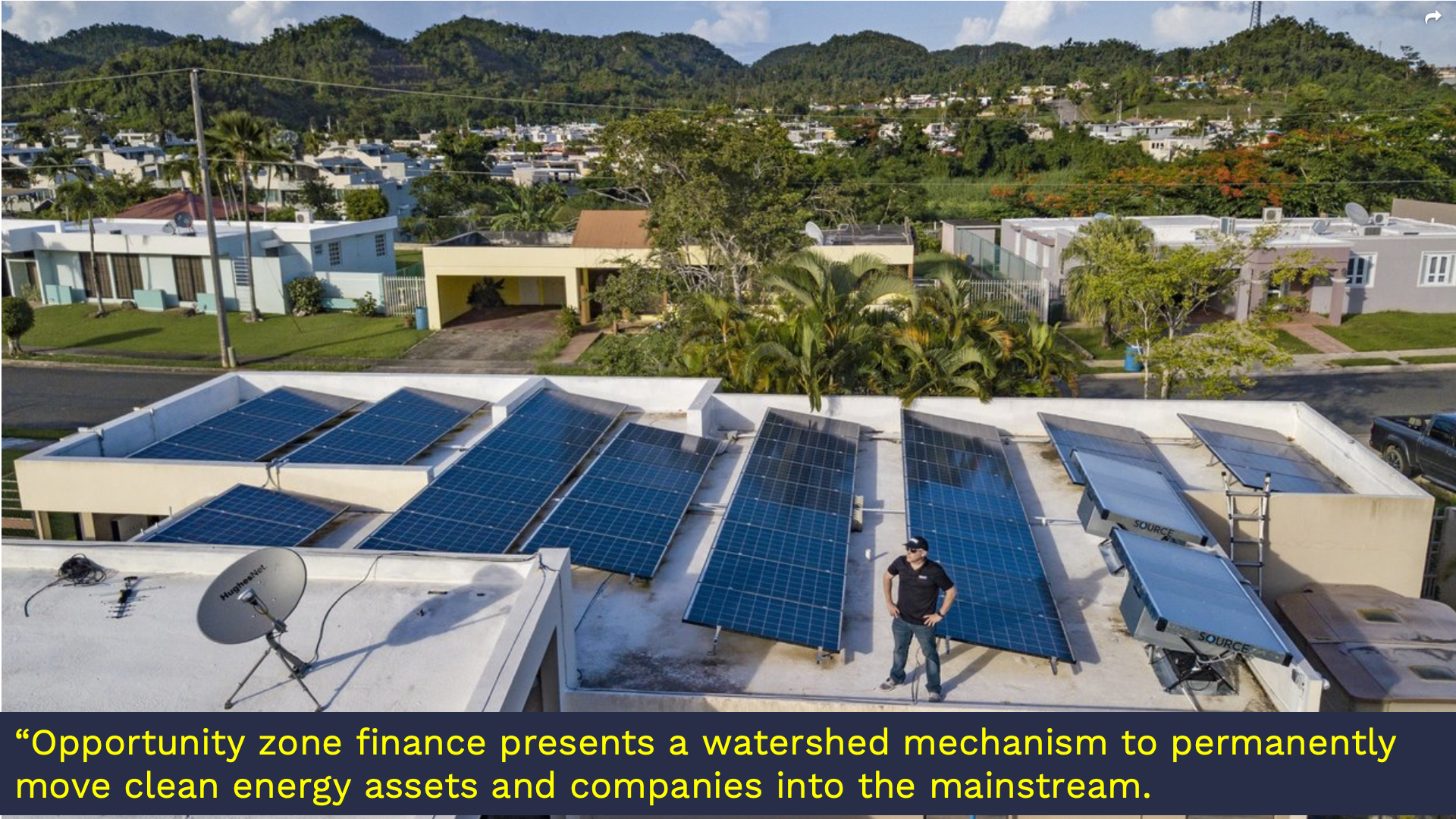

We want to increase ownership in our communities, and one way to do that is ownership of local infrastructure like renewable energy or broadband. Here is a project in Puerto Rico where the investors make their return and then the asset is owned by a community co-op, permanently reducing their electric costs. Across the board this is major investment type in opportunity zones.

*quote above is from Jon Bonanno, New Energy Nexus.

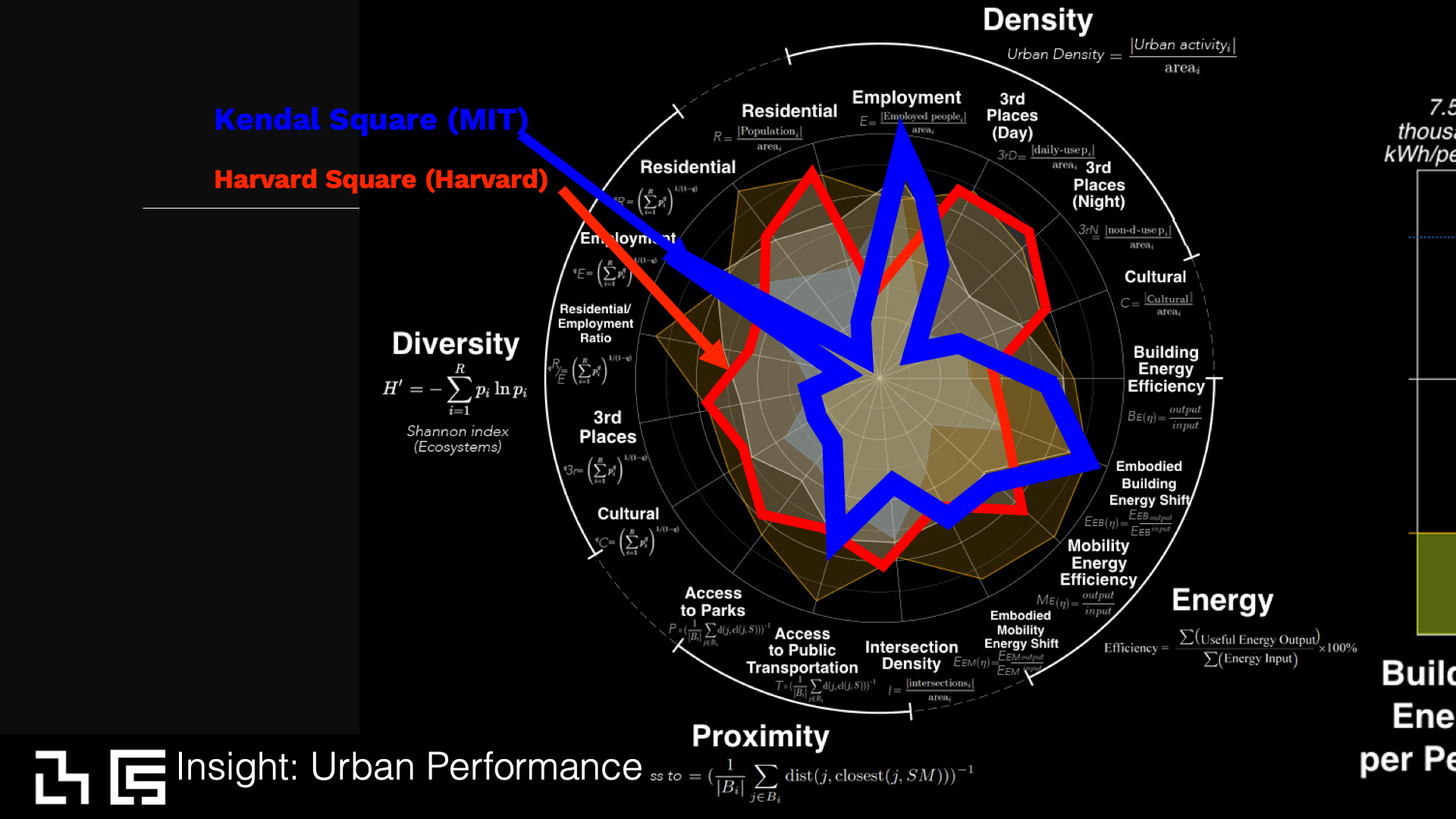

Finally, here’s a project our firm, Maker City, has been working on with the MIT Media Lab to measure return on investment and model positive impact in communities. It’s a data driven collaborative planning system.

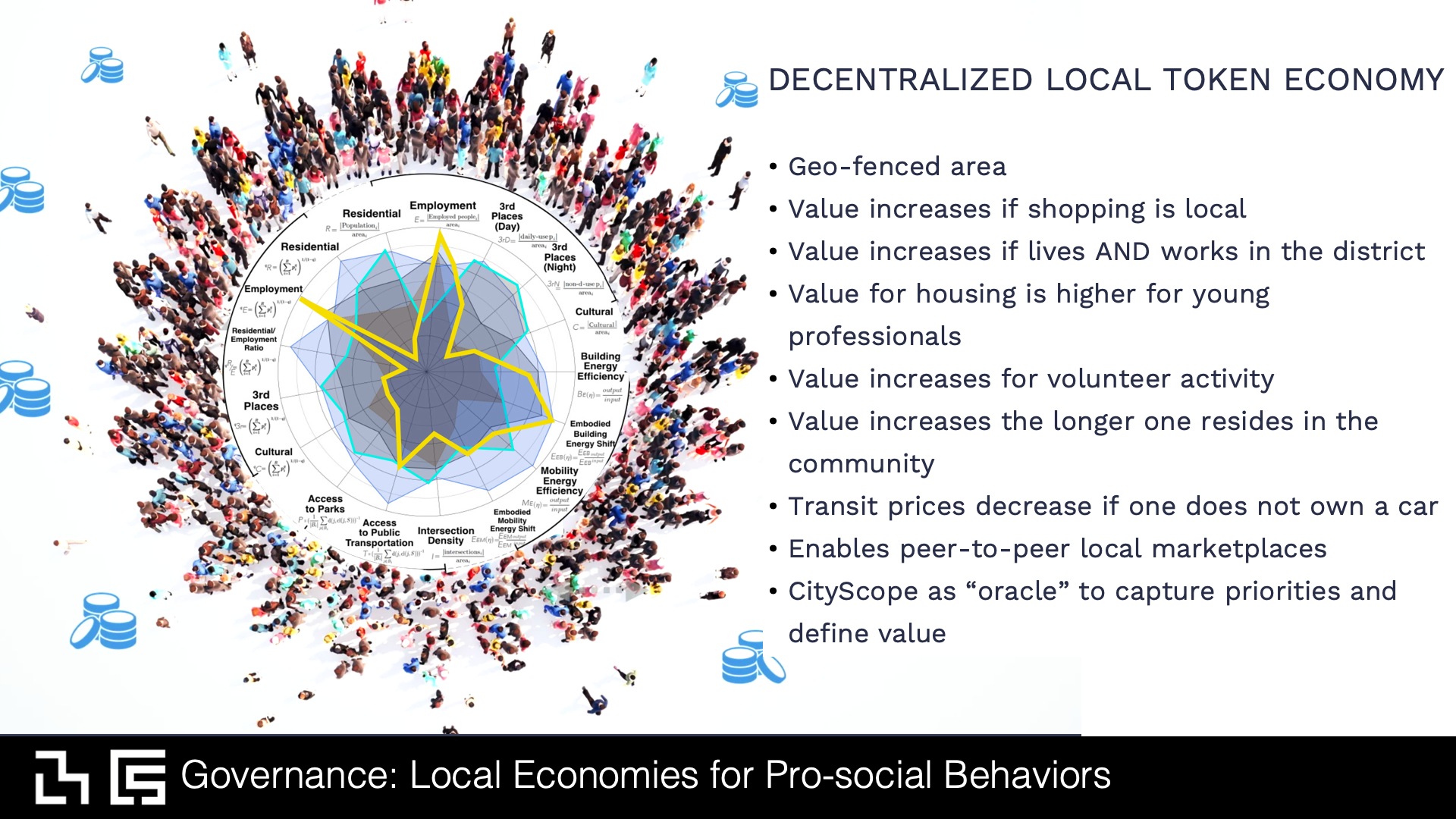

We can render explicit the attributes we might seek in a community: proactive heath, autonomous mobility, affordable housing. We can take the factors cities want to solve for…

…and turn them into a living simulation, which can achieve consensus, help predict outcomes, make decision making more inclusive. For example, if we dial up density or mobility, how will it affect affordability?

A system like this can go beyond planning and measurement and be used for dynamic governance to promote pro-social behaviors such as rewarding local production, community contribution, or circular economies. In this age of concentrated wealth and tech backlash, these distressed communities are exactly the places to trial less extractive forms of capitalism and mechanisms that reward community engagement.

Yes, we’re at a Frontier Again. Our cites are organizing in new ways to rebuild and renew. Have you noticed this frontier is a canvas for much of what we’ve seen at the Near Future summit?

This time help is not coming from on high. We’re weaving our futures locally, networking them nationally. We’re unleashing new forms of capital and getting real-estate, start-up capital and philanthropy to work as one ecosystem. To help ignite all this: opportunity zones, a multi hundred-billion-dollar boost with an exceedingly short timeline. Our timeline.

I’ve only touched the surface today. There is a lot more about Opportunity Zones, a deep dive on Fresno, and the prospectuses from dozens of cities all on our site. You can also read our book Maker City based on work we did with the Obama administration and how 100 cities are reinventing America. And fresh today – the localist manifesto, a call to action which comes from our collaboration with the USC Annenberg School.

Oh, and one more thing…

This time around perhaps we can make the frontier a bit more just than the last time around.

I’m inspired by two master builders who’ve never appeared on screen together before. We want to channel the spirit of both as we approach of today’s challenges. Quintessential Americans, Dr. King is the architect of justice and economic participation. Robert Moses is the restless urban builder who remade New York. Imagine if they worked together. Talk about people who restlessly wanted to get the future done now. Now it’s our turn to help America achieve her Local Maximum.